Explaining Bull and Bear Markets : How to Identify and React to Market Trends

Understanding market trends is essential for any investor or trader seeking success in the financial world. This is especially true if you are a first-time investor and don’t want to get a bad experience. It might leave a bad taste in your mouth and you might not want to continue investing!

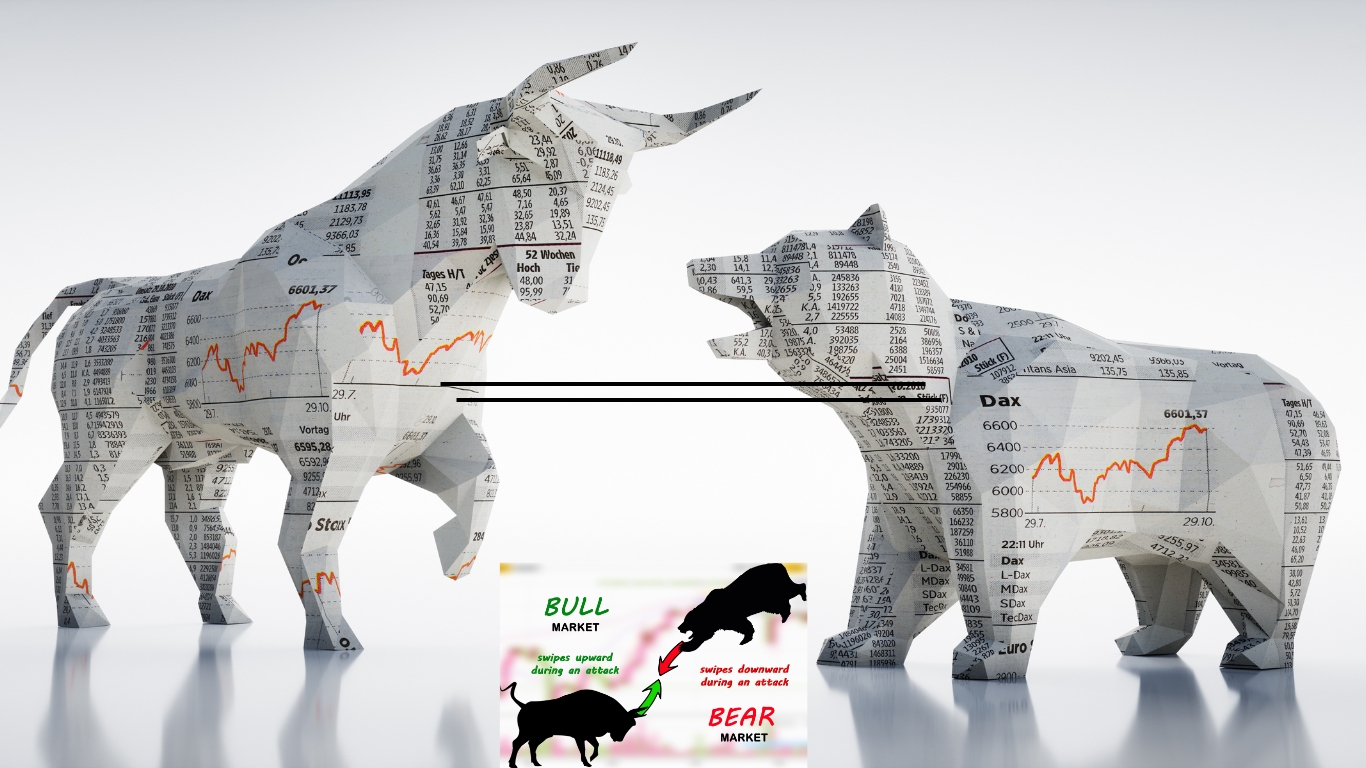

Two primary market conditions that dominate the landscape are bull markets and bear markets. In this blog, we will delve into the characteristics of bull and bear markets, explain how to identify them and provide valuable insights on how to react to these market trends.

By gaining a deeper understanding of these concepts, investors can make more informed decisions and navigate the complexities of the market with confidence.

I. What is a Bull Market?

A bull market is characterized by a sustained period of rising stock prices, accompanied by overall optimism and investor confidence. During a bull market, there is a general expectation that the upward trend will continue, leading to increased buying activity.

Key features of a bull market include:

Positive Economic Indicators: Bull markets are often fueled by strong economic fundamentals, such as low unemployment rates, rising GDP, and increased consumer spending.

Rising Stock Prices: In a bull market, stock prices experience significant upward movement across various sectors and industries. The overall market sentiment is positive, leading to higher demand for stocks.

Increased Investor Optimism: Bull markets create a sense of optimism among investors, resulting in increased risk appetite and a willingness to invest in stocks, bonds, and other financial instruments.

For example:

The period from 2009 to early 2020 witnessed one of the longest and strongest bull markets in history. Following the global financial crisis, the stock market experienced a remarkable recovery, with major indices, such as the S&P 500 and Dow Jones Industrial Average, reaching new all-time highs.

II. What is a Bear Market?

A bear market is the opposite of a bull market, characterized by a sustained period of declining stock prices and pessimistic market sentiment. During a bear market, there is widespread fear and uncertainty, leading to selling pressure and decreased investor confidence.

Key features of a bear market include:

Negative Economic Indicators: Bear markets are often associated with economic downturns, high unemployment rates, falling GDP, and reduced consumer spending. These factors contribute to a pessimistic outlook for the market.

Falling Stock Prices: In a bear market, stock prices experience a significant decline across various sectors and industries. Investors sell their holdings due to fear of further losses, leading to a downward spiral in prices.

Decreased Investor Confidence: Bear markets instill fear and uncertainty among investors, causing them to reduce their exposure to stocks and seek safer investments like bonds, cash, or gold.

For example:

The global financial crisis of 2008-2009 marked a severe bear market. Stock prices plummeted and major indices suffered substantial losses. It took years for the market to recover from the downturn and regain its previous levels.

III. How to Identify Bull and Bear Markets

Identifying bull and bear markets is crucial for making informed investment decisions. Here are some methods to help identify these market trends :

Technical Analysis : Technical analysis involves studying price patterns, trends and indicators on charts to identify market trends. Moving averages, trendlines and chart patterns can provide insights into whether the market is in a bull or bear phase.

Fundamental Analysis : Fundamental analysis examines economic indicators, corporate earnings and other factors to assess the overall health of the market. Positive indicators suggest a bull market, while negative indicators indicate a bear market.

Market Sentiment: Market sentiment refers to the prevailing attitude and emotions of investors. Positive sentiments, such as increased buying activity and positive news coverage, may indicate a bull market, while negative sentiment suggests a bear market.

IV. Reacting to Bull and Bear Markets

Reacting appropriately to bull and bear markets can help investors protect their portfolios and seize opportunities. Here are some strategies to consider when reacting to bull and bear markets :

Bull Market Strategies :

a. Stay Invested: During a bull market, it is often wise to stay invested and take advantage of the upward momentum. However, it is crucial to regularly review your portfolio and make necessary adjustments to ensure diversification and risk management.

b. Take Profits: As stock prices rise, consider taking profits by selling a portion of your holdings. This allows you to secure gains and reduce exposure to potential market downturns.

c. Identify Growth Opportunities: Bull markets create favorable conditions for growth-oriented investments. Look for sectors or companies with strong growth potential and invest accordingly.

Bear Market Strategies:

a. Preserve Capital: In a bear market, the primary goal is to preserve capital and minimize losses. Consider reallocating investments to more defensive assets such as bonds, cash, or defensive sectors that tend to perform relatively well during downturns.

b. Diversify and Hedge: Diversification across asset classes, sectors, and geographies can help reduce the impact of a bear market. Additionally, consider using hedging strategies like options or short-selling to protect against further declines.

c. Identify Value Investments: Bear markets often present opportunities to purchase quality assets at discounted prices. Look for fundamentally strong companies or undervalued assets that have the potential to rebound when market conditions improve.

Long-Term Perspective:

Regardless of the market trend, maintaining a long-term perspective is crucial. Trying to time the market consistently is challenging and often leads to suboptimal outcomes. Instead, focus on a disciplined investment strategy based on your financial goals and risk tolerance.

Conclusion

Bull and bear markets are fundamental concepts in the financial world. Understanding their characteristics can greatly enhance your investment decision-making process.

Remember that market trends are cyclical, and it is essential to adapt your strategy based on the prevailing conditions. It is also important to customize your strategy based on your financial situation and goals in the long run.

By staying informed, diversifying your portfolio, and maintaining a long-term perspective, you can navigate both bull and bear markets with confidence, ultimately increasing your chances of achieving financial success.